In Denver's competitive construction market, specialized construction loans are vital for developers and builders. These loans offer flexible financing for residential, commercial, and mixed-use projects, ensuring capital is available at key stages of development. Securing a construction loan denver requires robust creditworthiness, detailed project plans, substantial down payments, and careful navigation through stringent eligibility criteria and lender evaluations. Effective financial management, including strategic budgeting and transparent record-keeping, is crucial for successful project completion in this dynamic landscape.

“Construction loans are a vital source of financing for ambitious building projects in Denver. This comprehensive guide explores the ins and outs of securing funding for your next construction venture, focusing on Denver’s unique landscape. We’ll delve into the various types of construction loans available, their benefits, and how they differ from traditional mortgages. Additionally, we’ll navigate the eligibility criteria and provide a step-by-step application process to ensure a smooth journey towards realizing your project’s potential.”

- Understanding Construction Loans: Types and Benefits for Projects in Denver

- Eligibility Criteria: Requirements for Construction Loan Approval in Denver

- Application Process: Step-by-Step Guide to Securing a Construction Loan in Denver

- Management and Repayment Strategies: Optimizing Your Construction Project's Financial Health

Understanding Construction Loans: Types and Benefits for Projects in Denver

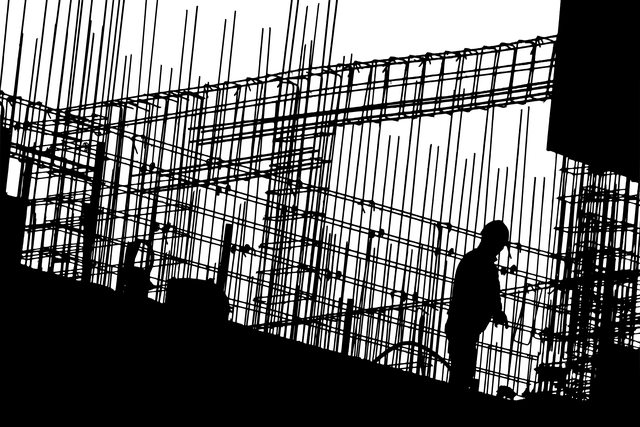

In the dynamic landscape of construction projects, understanding various financing options is paramount for success in Denver. Construction loans stand out as a tailored solution, designed to meet the unique needs of builders and developers navigating the complex process of bringing physical structures to life. These specialized loans offer a financial lifeline, enabling projects to progress from conception to completion.

Denver’s bustling construction scene presents both opportunities and challenges. Construction loans in this vibrant market cater to diverse project types, including residential, commercial, and mixed-use developments. Key benefits include flexible terms that align with the project lifecycle, allowing borrowers to secure funding during critical phases like excavation, framing, and finishing. This financial support not only facilitates timely project delivery but also ensures builders have capital accessible when it matters most, ultimately contributing to the city’s ever-evolving tapestry of construction projects.

Eligibility Criteria: Requirements for Construction Loan Approval in Denver

In Denver, securing a construction loan involves meeting specific eligibility criteria set by lenders. Potential borrowers should demonstrate strong creditworthiness, with a good credit history and a stable financial background. Lenders typically assess income stability and may require minimum debt-to-income ratios to ensure repayment capacity. A solid down payment is also essential, usually expressed as a percentage of the project cost, to mitigate risk for the lender.

Additionally, construction loan applicants in Denver must provide detailed project plans and proposals. This includes architectural designs, engineering reports, and cost estimates from experienced contractors. Lenders carefully evaluate these documents to gauge the feasibility and potential success of the construction project before approving funding.

Application Process: Step-by-Step Guide to Securing a Construction Loan in Denver

Securing a construction loan in Denver is a multi-step process that requires careful preparation and documentation. First, prospective borrowers should gather essential financial records, including tax returns, bank statements, and business financial statements. This step is crucial as it demonstrates your creditworthiness to lenders. Next, determine the project’s scope and budget by consulting with architects and engineers; this ensures a clear understanding of costs and helps tailor loan applications accordingly.

Once ready, start by researching and comparing Denver-based lenders that specialize in construction loans. Apply for pre-qualification first to gauge your budget and get an idea of interest rates. Then, prepare detailed plans, specifications, and cost estimates, which are essential documents for a formal loan application. Finally, submit your application along with the required documentation. Lenders will review your materials, assess the project’s feasibility, and determine loan terms, including interest rate, repayment schedule, and potential collateral requirements.

Management and Repayment Strategies: Optimizing Your Construction Project's Financial Health

Effective management and repayment strategies are vital for maintaining the financial health of your construction project in Denver. One key approach is to secure a construction loan tailored to your specific needs. These loans, available from various lenders in Denver, provide much-needed capital upfront, allowing you to cover initial expenses like materials, labor, and site preparation. By understanding the terms, interest rates, and repayment schedules of these loans, you can create a strategic plan for successful repayment.

Implementing robust financial management practices, such as meticulous budgeting, regular cash flow monitoring, and timely invoice payments, will ensure your project stays on track financially. Additionally, establishing clear communication channels with lenders and maintaining transparent records facilitates better loan management. This proactive approach not only optimizes your project’s financial stability but also paves the way for a smoother construction process in Denver.

Securing a construction loan in Denver is a strategic step towards transforming your project vision into reality. By understanding the various types available, navigating the eligibility criteria, and adopting effective management strategies, you can ensure a smoother financial journey. This comprehensive guide has equipped you with the knowledge to make informed decisions, allowing you to focus on the exciting prospect of building in this vibrant city. Remember, when it comes to construction loans Denver has many options, and with the right approach, your project can thrive.